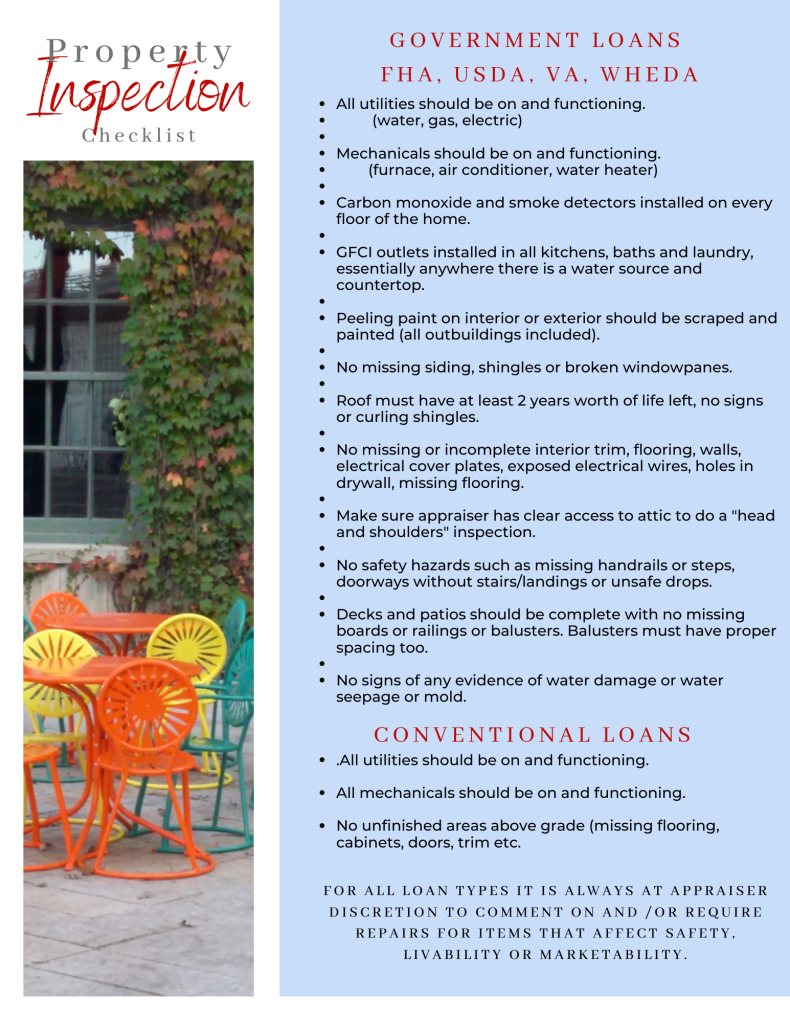

I think one of the biggest fears for sellers is a buyer that is pre-approved for a government loan program. This fear is not based on the ability of the buyer to have sufficient finances to obtain the loan but rather on the possible reasons the home could be denied for the loan. Yes, you read that right, the home can be denied.

Let me say though that with the hundreds of transactions I’ve handled, very rarely does an offer to purchase fall through due to the condition of the home. Generally, there are some basic repairs that need to be made but the seller and buyer can negotiate how to get that done. One recent case, three steps outside a home needed a handrail. I was working with the buyer and I suggested to them that they offer to build it themselves before closing. The seller was a single woman who was not in a great financial position to hire someone to get the job done. The buyer on the other hand was a couple with some basic skills so they built the handrail themselves in a matter of days.

I’ve had buyers willing to paint or scrap paint off decks. Oddly enough paint stripped off wood is fine for government loans, you just can’t have peeling paint. Other times the buyers swapped traditional outlets with GFCI outlets. For the person with the right skill set, the list of possible issues really are pretty minor things. Sellers shouldn’t fear the possiblility of repairs because a willing buyer just might do the work for you.