Liz Walker | Juneau County Real Estate Expert

What Would a Local Real Estate Professional Actually Do in This Market?

If you live in Juneau County, you already know our market doesn’t behave like Madison, Milwaukee, or what you see on national headlines. Homes here move differently. Inventory behaves differently. Buyers and sellers make decisions based on real life — not trends on TikTok or cable news.

Still, the uncertainty is real.

Whether you’re buying, selling, or staying put in New Lisbon, Mauston, Necedah, Elroy, Wonewoc, or Lyndon Station, it’s normal to wonder if now is the right time to make a move.

Most people don’t buy or sell property often. And when they do, the stakes feel high — especially in a market where interest rates, affordability, and inventory are all part of the conversation.

One question comes up again and again:

What would a local real estate professional actually do in this market?

Not in theory. Not based on national advice. But based on how real estate actually works here in Juneau County.

This guide breaks that down.

If I Were Buying a Home in Juneau County Right Now

Buying a home in Juneau County comes with unique considerations. We don’t have endless new construction. Many homes are older. Inventory varies wildly by town, neighborhood, and even by street.

Here’s how I’d approach buying locally right now.

Location Matters — Even More in Small-Town Markets

In Juneau County, location isn’t just about the city name — it’s about the street, the lot, and the surroundings.

When evaluating homes in places like New Lisbon, Elroy, or Wonewoc, I’d pay close attention to things that don’t show up in listing photos: proximity to highways or rail lines, traffic flow, neighboring properties, floodplain considerations, and how the home fits into the immediate area.

You can update kitchens. You can replace flooring. You can’t move the house.

A solid location in Mauston or a well-positioned property in Necedah will hold value far better long-term than a fully renovated home in a compromised spot.

Financing Strength Matters in Our Local Market

In Juneau County, sellers care deeply about certainty. A strong offer isn’t just about price — it’s about confidence that the deal will close.

That’s why lender choice matters. I’d want a lender who understands rural appraisals, well and septic systems, older housing stock, and local timelines. Missed deadlines or appraisal issues can derail deals quickly in smaller markets.

A well-prepared buyer with a reliable lender often beats a higher offer that feels risky.

Trying to Time Rates Can Backfire Locally

Many buyers are waiting for rates to drop — and when they do, competition here will increase. That’s especially true in affordable price ranges common in Juneau County.

Lower rates often bring more buyers into the market, which can push prices up and reduce negotiating power. The difference in monthly payment between waiting and acting now is often smaller than people expect.

Personally my husband and I have refinanced our mortgage several times in order to take advantage of a lower interest rate. We purchased our first home with a 9% rate then a couple years later rates dropped to 7%. Our current home was initially at a 6.5% rate and over the last 20 years we’ve managed to refinance that down below 3%. The point is don’t wait for the low rate to buy, rather buy now and refinance if the rates fall by at least a percentage point.

If the home fits your budget, lifestyle, and long-term plans, waiting for perfect conditions can mean missing the right opportunity.

Buyer Takeaway (Juneau County Edition)

I wouldn’t wait for a “perfect” market. I’d stay ready and act when the right home, in the right location, at the right price shows up.

If I Were Selling a Home in Juneau County Right Now

Selling in Juneau County requires a different mindset than larger metro areas. Buyers here are practical, informed, and cautious — but they are absolutely active.

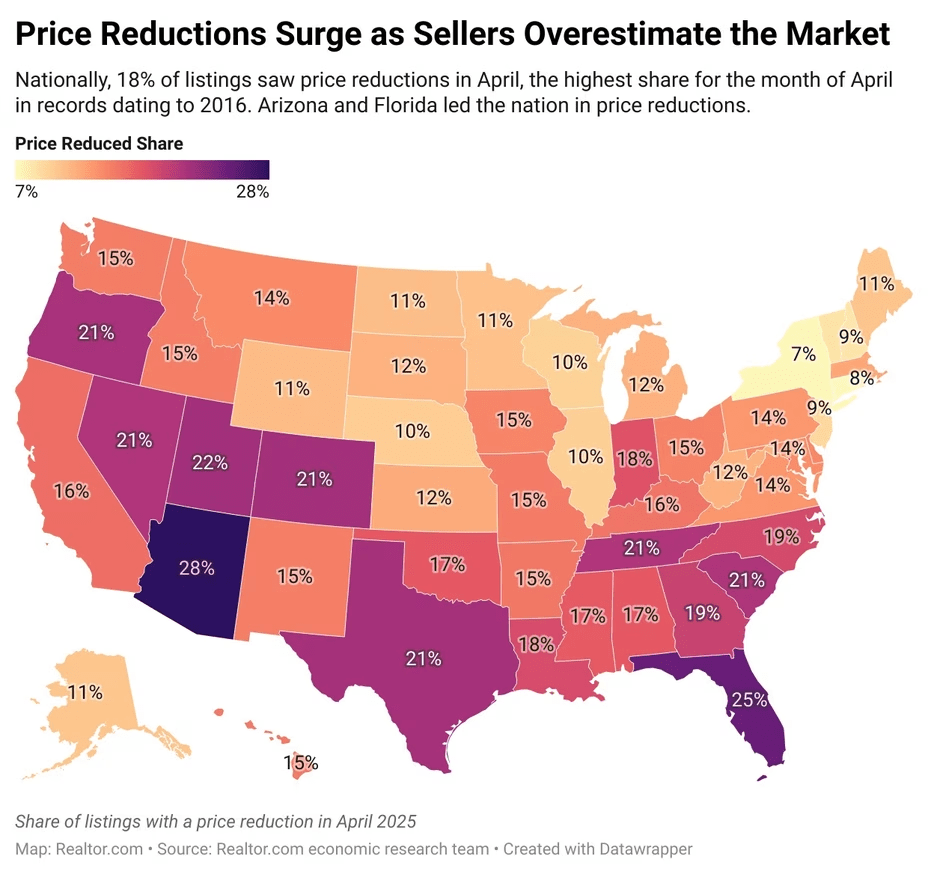

Strategic Pricing Creates Momentum

Overpricing is especially damaging in smaller markets. When a home sits too long in New Lisbon or Lyndon Station, buyers notice — and they start asking why.

Pricing slightly below market value can bring in more qualified buyers, create urgency, and sometimes generate multiple offers. Momentum matters, even here.

Homes that launch correctly often outperform homes that chase the market downward.

Preparation Still Wins — Even Outside Spring

Serious buyers don’t shop based on seasons alone. Job changes, family needs, and life events happen year-round.

If I were selling, I’d treat it like peak season: create curb appeal, a clean and well-presented home, and addressing known issues upfront. In older housing markets like ours, pre-listing inspections can be especially powerful in building buyer confidence.

Prepared homes stand out — and they sell stronger.

Personal Timing Beats Market Headlines

Whether you’re upsizing, downsizing, relocating, or simplifying life, your timeline matters more than headlines.

A well-prepared home in Juneau County can sell successfully in any season when pricing and strategy align. Waiting isn’t always safer — especially if you’re already ready.

Seller Takeaway (Juneau County Edition)

I wouldn’t try to time the market. I’d prepare for it, price smart, and move forward when it makes sense for my life.

If I Were a Homeowner in Juneau County Right Now

Homeownership here often means older homes, ongoing maintenance, and long-term planning.

Protect the Structure First

Roofing, siding, drainage, HVAC, plumbing, and foundation issues should come before cosmetic updates. In our climate, deferred maintenance can turn into expensive problems fast.

Not everything needs to be fixed immediately — but priorities matter.

Stay Informed on Value and Equity

I’d keep track of recent sales in my area — not for comparison, but for awareness. Knowing your home’s value helps with refinancing, planning renovations, or preparing for future moves.

Home equity is a tool — but only if you understand it.

Treat the Home Like an Asset

Insurance coverage, property tax accuracy, homestead exemptions, and maintenance records all matter. Being proactive gives homeowners flexibility if life changes quickly.

Homeowner Takeaway (Juneau County Edition)

I’d treat my home like a long-term asset — one that benefits from planning, care, and attention.

Final Thoughts: A Juneau County Real Estate Reality Check

Real estate decisions don’t need to feel overwhelming — but they do need to be grounded in reality.

Juneau County isn’t driven by national trends alone. It’s driven by people, timing, preparation, and local knowledge. Whether you’re buying, selling, renting, or staying put, the smartest decisions come from clarity — not noise.

This is how I’d approach the market right now, right here.

And if you ever want to talk through your options — based on your town, your timeline, and your goals — that’s a conversation worth having.

Ready to Talk Real Estate?

Serving Mauston, New Lisbon, Necedah, Elroy, Wonewoc, Lyndon Station, Wisconsin Dells, Adams, Friendship, Tomah, Camp Douglas, and Oakdale

Contact Liz Walker | RE/MAX