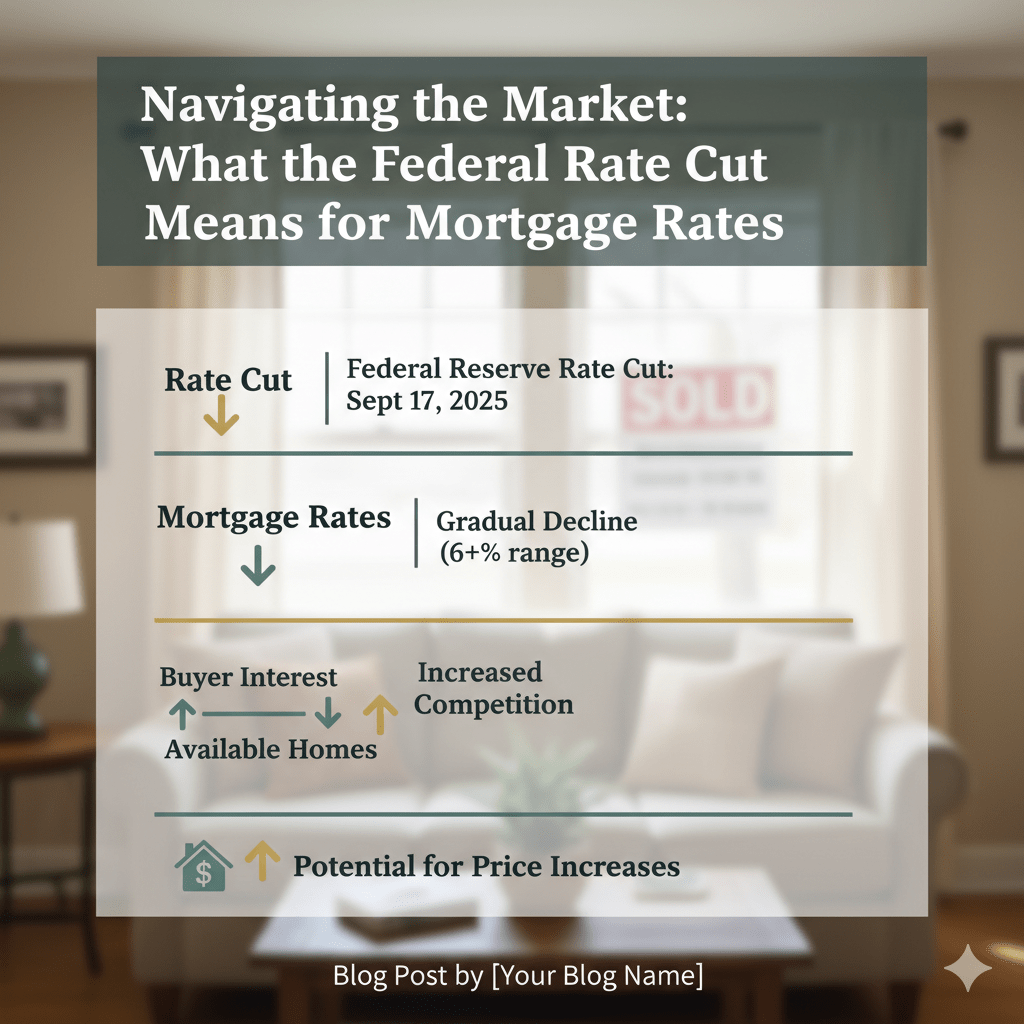

The Federal Reserve’s recent decision on September 17, 2025, to cut its benchmark interest rate by a quarter-point to a new range of 4.0% to 4.25% has homeowners and prospective buyers wondering about the impact on mortgage rates. While the news is a positive sign for borrowers, the immediate effect on mortgage rates is not as dramatic as you might think.

The Market’s Reaction: A Case of “Anticipation”

The Federal Reserve does not directly set mortgage rates. Instead, mortgage rates tend to follow the yields on long-term government bonds, such as the 10-year Treasury note. In the weeks leading up to the Fed’s announcement, the bond market had already “priced in” the widely expected rate cut. This means that investors’ anticipation of the cut had already driven mortgage rates down. For example, the average rate for a 30-year fixed mortgage had already fallen to an 11-month low of 6.35% last week.

As a result, the immediate impact of the official announcement was minimal. The White House reported that rates fell to their lowest level in three years, and Mortgage News Daily noted that the average 30-year fixed mortgage dropped 12 basis points to 6.13%. However, most of the impact was felt in the weeks leading up to the decision.

The Real Estate Market Outlook

For the housing market, this rate cut is a welcome signal. The decision was driven by concerns over a weakening labor market, which could indicate a “risk management” approach by the Fed to prevent a slowdown.

- For Homebuyers: While a significant drop in mortgage rates is not expected immediately, the rate cut will likely contribute to a continued, gradual downward trend. This offers some relief and could encourage those who have been waiting on the sidelines to re-enter the market. While buyer interest will likely increase, this demand will intensify competition for available homes, which could push up prices in some areas.

- For Homebuilders: The rate reduction has a direct, beneficial effect on the interest rates for construction loans. This will help reduce lending costs for builders, potentially leading to more attainable housing supply in the future.

In short, while the Fed’s rate cut is a positive development, it is not a magic bullet that will instantly slash mortgage rates. Instead, it’s a signal that provides downward pressure on rates and could help stabilize the housing market, making it a little more accessible for both homebuyers and builders. Most experts expect mortgage rates to remain above 6% through the end of the year, so if you are ready to buy, it may not be prudent to wait for a significant plunge.