What Credit Score Do You Need to Buy a House?

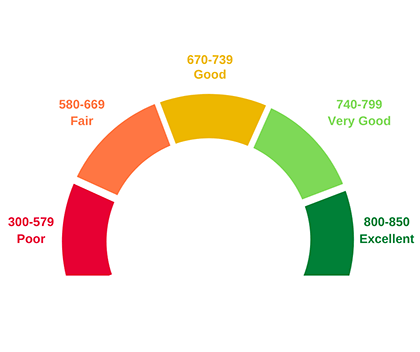

Thinking about buying your first home but worried your credit score isn’t high enough? Don’t stress—you don’t need perfect credit to become a homeowner. Many people buy homes with scores that are far from perfect. Whether your score is in the 700s or in the 500s, there are loan options that may work for you.

Why Your Credit Score Matters

Your credit score is a number that shows how well you’ve handled money in the past. Lenders use it to decide:

- If you can get a loan

- What interest rate you’ll pay

- How much money you need to put down

A higher credit score usually means:

- Better chances of getting approved

- Lower interest rates (which saves you money)

- Smaller down payments

Even small changes in your credit score can affect how much you pay each month. So, the higher your score, the better your deal will be.

What’s the Minimum Credit Score to Buy a Home?

Here’s a quick breakdown of the common loan types and the credit scores they usually require:

Conventional Loans

- Minimum score: 620

- Easier if your score is 640 or higher

- Best rates if your score is 700+

If your score is on the lower end, you may pay a higher interest rate or need to show stronger proof of income.

FHA Loans

- Minimum score: 500 (with 10% down)

- 580+ qualifies for only 3.5% down

FHA loans are great for first-time buyers with lower credit scores.

VA Loans (for Veterans and Active Duty)

- No official minimum score

- Most lenders like to see 580–620

VA loans have no down payment and low interest rates if you qualify.

USDA Loans (for rural or small-town homes)

- No set score, but most lenders want 640 or higher

If your score is under 640, you’ll need more paperwork, but it’s still possible.

What If Your Credit Score Is Low?

Don’t worry—there are still ways to become a homeowner:

🏦 Check with Credit Unions or Local Banks

Some credit unions are more flexible and look at your full financial story, not just your credit score.

🏡 Way to Improve Your Credit

- Apply for a credit card for a place you regularly fuel up your car like Kwik Trip, Citgo or BP. Use it only for fuel and pay it off in full every month. It takes 6 months to a year of perfect credit history but it will increase your credit score.

- Pay down debt. If you have multiple credit cards or small loans, work on paying those balances down and don’t open any new accounts. Also, don’t cancel those paid off cards. Leaving them open with no balance improves your credit.

- Make your payments on time.

👥 Add a Co-Signer or Co-Borrower

If a family member or partner with better credit applies with you, you may qualify for a better loan. Just remember, they’ll be responsible too if payments aren’t made.

Final Thoughts

Your credit score matters, but it’s not the only thing lenders look at. Income, savings, job history, and debt also play a big part. Even if your score isn’t great right now, there are options out there—and professionals who can help.

🏠 Ready to take the next step?

Reach out to me, I can help you:

- Understand your credit situation

- Find loan options that match your score

- Connect with lenders who are ready to work with you

You can buy a home—even with less-than-perfect credit. Let’s make your dream of homeownership a reality!