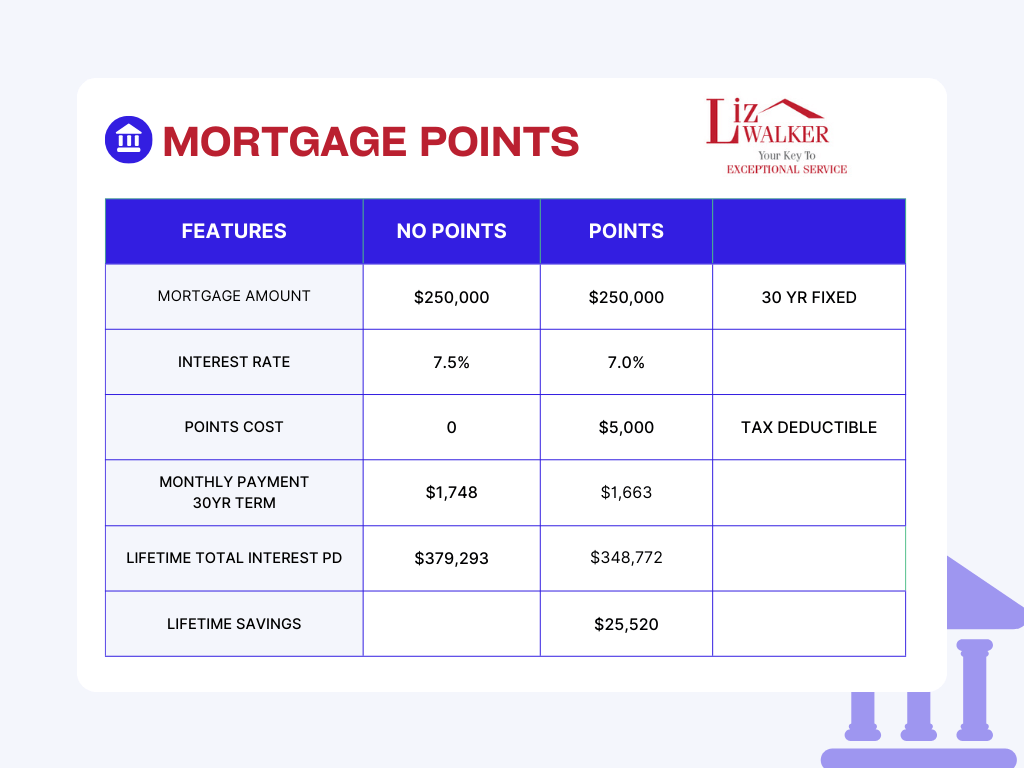

Sellers, if you are waiting to make a move because your current mortgage is locked in at a very low interest rate and the current rates scare you, here’s an option to help. Lenders offer you a way to “buy” a lower interest rate. This is called mortgage or discount points. In the simplest description, you pay interest upfront to lower the interest rate on your loan.

This option works best for sellers who have built up equity in their home. Those would be people who have owned their home for at least the last 5 years or longer. Home prices have increased greatly since 2019 so even if you haven’t paid much off on your home the market has helped to increase your equity. Another ideal seller to take advantage of this is one looking to downsize from a more expensive home to a smaller one. Using the net profit from the sale of your home, you can purchase points to lower your interest rate.

1 point = 1% of the mortgage amount which lowers your interest rate by .25%

This amount is prepaid interest, so it is tax deductible.

If you are interested in this, first contact me to give you an idea of the current value of your home. Then reach out to your lender for details on the mortgage aspect to see if it could work for you.

This is a pretty simple question but it’s come to my attention that most people aren’t aware that you can look up your own credit score for free. The federal government recommends using this website: https://www.annualcreditreport.com. The big three credit reporting companies, Equifax, TransUnion and Experian, are available from this site.

Lenders may use any one of these companies to obtain credit history on you so it’s important to check that the accuracy of your information with all three companies. While the reports and credit scores should be fairly consistent among these companies, it is possible that one has error while the other two do not. I recommend checking your credit at least once a year.

I personally have been using Credit Karma, https://www.creditkarma.com/, to monitor my credit for fraudulent use. A few years ago my debit card was one of thousands that had been hacked at a store and that store recommended using this service and it’s FREE! Plus the site also offers free credit monitoring which is more important. It automatically keeps on an eye on your credit and sends you notifications if something changes. Plus it offers suggestions on how to improve your score.

I took the photo of this wall in a house while I was showing it, thankfully not my listing. My guess is that this “wallpaper” is actually pages from a graphic novel (comic book to us older generations). The whole room had a black and white color theme going on so this one wall worked well with that theme. But… can you imagine being the next owner of that room and having to try to remove these pages? Plus most buyers are going to have a hard time envisioning themselves living in this space. The lesson here is to remove dated wallpaper or makes a unique wall like this so the space is neutral for the new owners.