As the peak period for residential home sales approaches, prospective buyers may encounter a broader selection of properties and increased search flexibility. This development should make it easier to buy for those who have previously struggled to locate a residence that aligns with their specific requirements.

The balance of negotiation leverage between buyers and sellers may be relatively even at present. This time last year, the market favored sellers. Currently, as the spring season commences, the market is more equal between buyers and sellers depending on the property.

It is essential to recognize that local market conditions can vary significantly, depending on what type of property you are buying. Vacation home sales are still going strong, while the local residential housing market is still a challenge for first time home buyers because there are limited properties available in the $150,000 – $250,000 price point. Here is a summary of general market trends and guidance for the upcoming months.

When does the primary period for residential real estate transactions begin?

The majority of sellers in WI typically list their properties during the spring season, starting with the spring rise in temperatures and reaching its peak in late May and early June. This timing aligns with the influx of purchasers, many of whom aim to finalize their relocation during the summer months when schools are in recess. The convergence of increased seller activity and purchaser interest characterizes spring as the most active period.

Will competitive pressures diminish in 2025?

The real estate sector is subject to seasonal fluctuations, with spring typically marking a period of heightened activity. However, fluctuations in mortgage interest rates, which have exhibited volatility over the past two years, also influence market dynamics. Decreases in interest rates tend to stimulate buyer activity, while rate increases tend to lower demand.

The average days on market for a single family home was near 3 months in the first quarter of 2025. This is double the previous year days on market of 1.5 months. It is noteworthy that competitively priced properties still tend to sell fast. I believe there has been a trend among sellers to list their property higher than the market comparisons would dictate. Sellers are still under the impression that home prices are rising quickly as happened during the Covid years but this is no longer true. The real estate market has returned to normal.

Our nation’s political climate and economy is certainly playing a large part in the movement of real estate. Buyers and sellers have been overly cautious since before the presidential election last year which has made market activity stagnant. The market isn’t crashing but it’s not quickly rising either.

Will a greater selection of affordable properties be available?

The availability of affordable properties is contingent upon individual budget constraints and local market conditions. The number of homes sold in 2024 hit a 30 year low. However, generally, experts are anticipating an increase to inventory during this spring over last year but it will be a small increase..

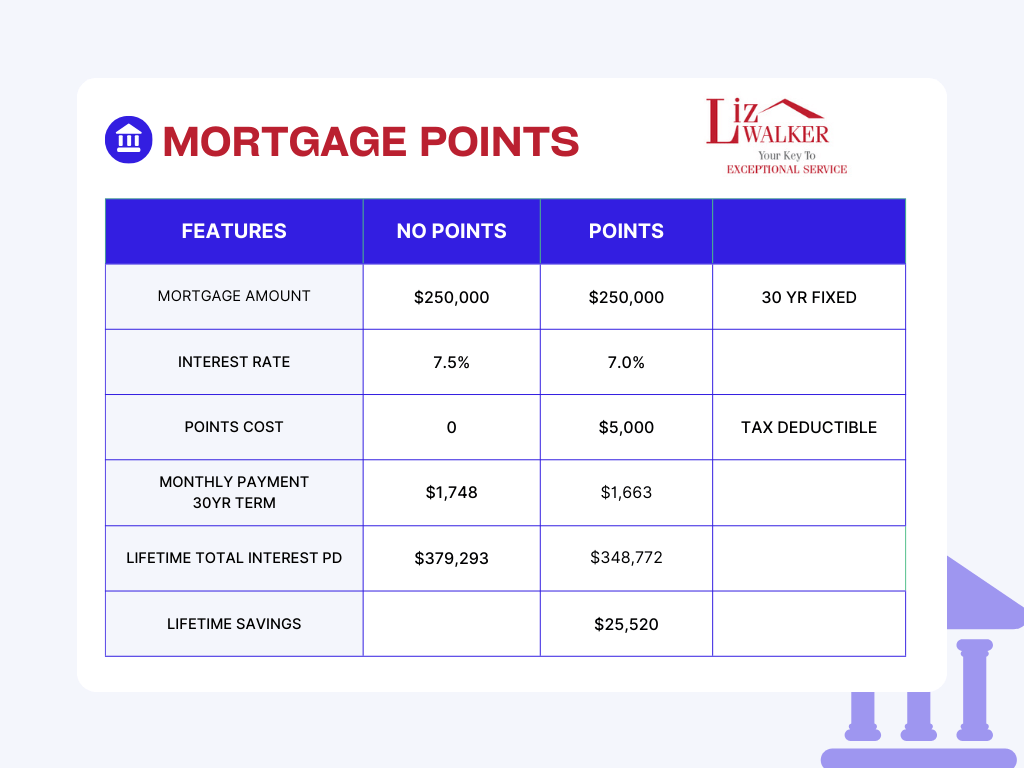

Will interest rate drop this year?

Consumers shouldn’t wait for interest rates to drop. The expectation is that rates will remain in the mid 6% range throughout most of the year. Economists don’t expect mortgage rates to drop below 6% this year at all. The low rates from the last five years are a thing of the past so don’t wait to make a move based on a low mortgage rate. More concerning will be the rising costs of building materials as the need for new home construction due destruction from flooding, hurricanes and wildfires. New home prices and the costs to remodel are going to continue to rise so don’t wait for the perfect time to make a move.