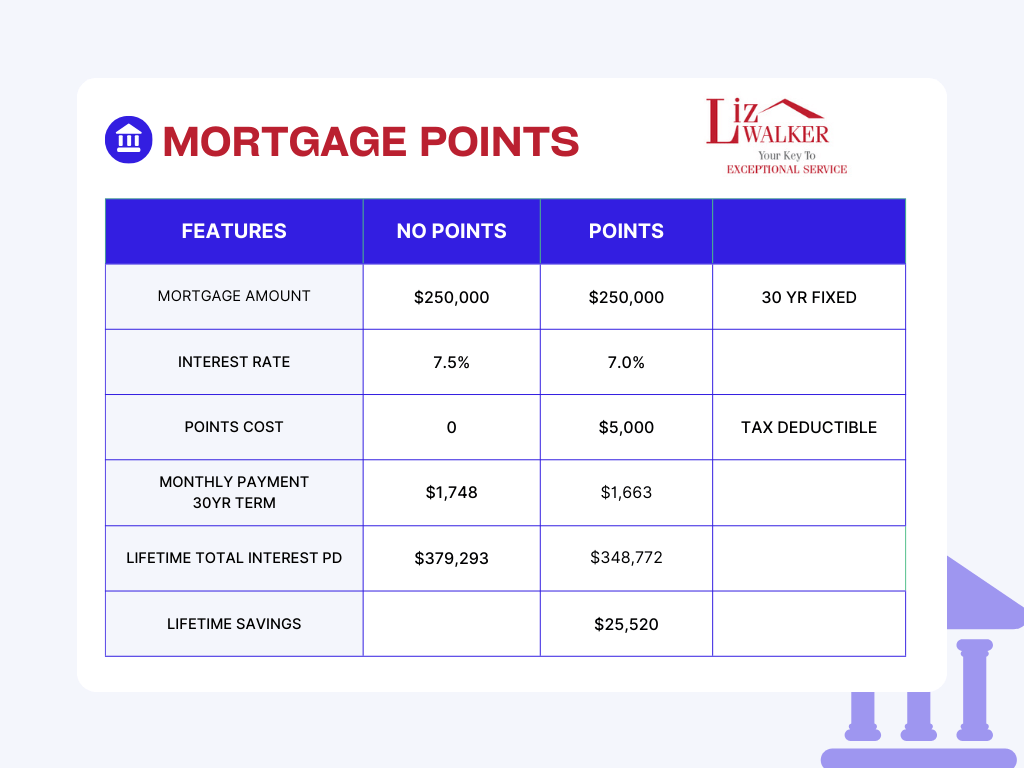

Sellers, if you are waiting to make a move because your current mortgage is locked in at a very low interest rate and the current rates scare you, here’s an option to help. Lenders offer you a way to “buy” a lower interest rate. This is called mortgage or discount points. In the simplest description, you pay interest upfront to lower the interest rate on your loan.

This option works best for sellers who have built up equity in their home. Those would be people who have owned their home for at least the last 5 years or longer. Home prices have increased greatly since 2019 so even if you haven’t paid much off on your home the market has helped to increase your equity. Another ideal seller to take advantage of this is one looking to downsize from a more expensive home to a smaller one. Using the net profit from the sale of your home, you can purchase points to lower your interest rate.

1 point = 1% of the mortgage amount which lowers your interest rate by .25%

This amount is prepaid interest, so it is tax deductible.

If you are interested in this, first contact me to give you an idea of the current value of your home. Then reach out to your lender for details on the mortgage aspect to see if it could work for you.

This is a pretty simple question but it’s come to my attention that most people aren’t aware that you can look up your own credit score for free. The federal government recommends using this website: https://www.annualcreditreport.com. The big three credit reporting companies, Equifax, TransUnion and Experian, are available from this site.

Lenders may use any one of these companies to obtain credit history on you so it’s important to check that the accuracy of your information with all three companies. While the reports and credit scores should be fairly consistent among these companies, it is possible that one has error while the other two do not. I recommend checking your credit at least once a year.

I personally have been using Credit Karma, https://www.creditkarma.com/, to monitor my credit for fraudulent use. A few years ago my debit card was one of thousands that had been hacked at a store and that store recommended using this service and it’s FREE! Plus the site also offers free credit monitoring which is more important. It automatically keeps on an eye on your credit and sends you notifications if something changes. Plus it offers suggestions on how to improve your score.

If you are thinking about buying a home but are overwhelmed with where to start, here are the instructions. I’ve created this informational guide to help you through the whole process. Got questions? Ask me, if I don’t know the answer I can certainly find the right person to help you. I can also lenders that I can refer you to.

It’s amazing what a simple coat of paint can do to transform the look of a room. It’s hard to convey to first time homebuyers how easy it can be to transform a dark, dingy looking fireplace into something beautiful. Yes, it does take a little bit of “elbow grease” to get the job done but it’s an affordable option that makes a huge impact. The puppy certainly makes a great addition too!

Do you know that the listing agent works for the seller? Their goal is to get the seller the highest price in the shortest amount of time. So why would you want to work with the list agent? You should want someone that is looking out for you!

A buyers agent will help you negotiate a realistic price. In a highly competitive market that favors the seller you want to make sure you aren’t overpaying when purchasing. Your agent will also help you through the process of the home inspection and negotiating for reasonable repairs. Your agent will be invested in seeing to your best interests.