Thinking about buying a vacation home in Juneau County? You’re in good company. The Castle Rock Lake area has become one of Central Wisconsin’s most sought-after spots for second homes — from wooded cabins tucked in peaceful pines to modern lake retreats near the water.

Owning your own escape near Castle Rock Lake means weekend getaways, family gatherings, and maybe even some short-term rental income. But before you jump in, here’s what to know to make sure your investment pays off — financially and emotionally.

The Real Costs of Owning a Castle Rock Lake Vacation Property

Buying a second home sounds simple — until you start adding up the hidden costs. Here’s what local buyers often overlook:

- Insurance premiums: Vacation homes typically cost more to insure, especially if unoccupied for long stretches or near the water.

- Maintenance: Plan for Wisconsin weather — snow, ice, and freeze-thaw cycles take a toll on roofs, decks, and driveways.

- Septic & well systems: Most rural lake-area homes have private systems that require regular inspection and service.

- Utilities: Electric heat, propane, and well pumps can all add up, especially if you keep the property “guest-ready” year-round.

- Cleaning & property management: If you’re renting it out on Airbnb or VRBO, budget for local cleaners and check-in services.

👉 Pro tip: Set aside 1–2% of your purchase price per year for upkeep and unexpected repairs. A $400,000 home could easily need $4,000–$8,000 annually in maintenance.

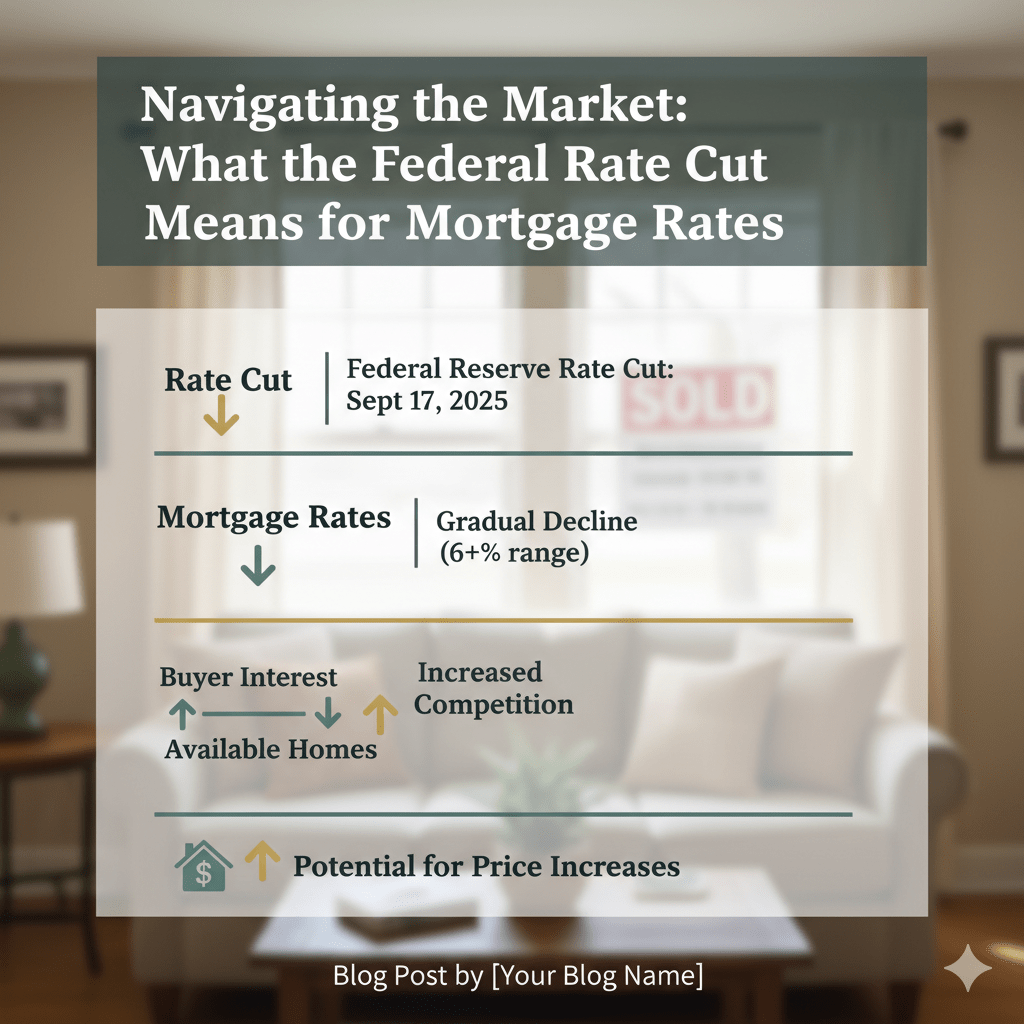

Financing a Vacation Home in Juneau County

Lenders treat vacation homes differently from your primary residence. Expect:

- Larger down payments: Usually 20% minimum.

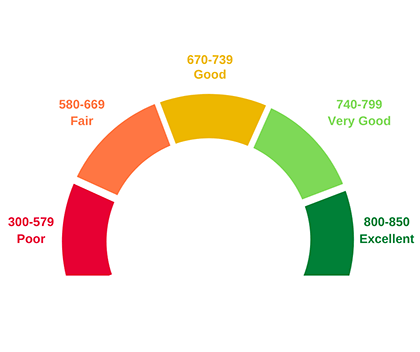

- Higher credit requirements: A stronger score means better interest rates.

- Limited rental income credit: Not all lenders count projected short-term rental income, even in high-demand markets like Castle Rock Lake.

Work with a Wisconsin lender who’s experienced with vacation and second home loans — they understand our market quirks better than national chains.

Personal Use vs. Rental Income

Before buying a lake property, decide how you’ll actually use it. Your choice affects taxes, insurance, financing, and location.

If your goal is personal enjoyment:

- Focus on proximity — the Castle Rock Lake area is ideal for owners within a 3-hour drive (Madison, Milwaukee, Rockford, Chicago Area).

- Look for properties near UTV trails, Buckhorn State Park, or waterfront dining like Shipwreck Bay or Dirty Turtle.

If you’re planning to rent it short-term:

- Choose areas with strong rental demand, such as Germantown or near Castle Rock County Park.

- Keep décor simple and durable.

- Hire a local cleaner or management company to handle turnovers.

Tax Considerations for Second Homes

Your rental strategy determines how the IRS classifies your property:

- Fewer than 15 rental days per year: No income reporting required.

- Mostly rented, limited personal use: You can deduct most expenses (and even report a loss).

- Used personally more than 14 days or 10% of rental days: You must report rental income but can only deduct expenses up to the rental total.

Keep good records of your rental days, personal stays, and expenses. A CPA familiar with Wisconsin rental properties can help you maximize deductions.

Why Castle Rock Lake Is the Perfect Wisconsin Vacation Spot

This isn’t just another lake. Castle Rock Lake is Wisconsin’s fourth-largest lake, known for its fishing, sandbars, and laid-back community vibe.

What Makes It Stand Out:

- All-season recreation: Boating, UTVing, fishing, snowmobiling, and golf — all in one place.

- Short drive from major cities: Roughly 2.5 hours from Milwaukee or Rockford.

- Low HOA restrictions: Many areas allow short-term rentals with minimal red tape.

- Strong property values: Limited inventory keeps appreciation steady.

Nearby communities like New Lisbon, Necedah, and Germantown offer everything from rustic cabins to luxury lakefront builds — perfect for both second-home owners and Airbnb investors.

Property Management in the Castle Rock Lake Area

If you’re not local, consider hiring a property manager. They’ll handle bookings, cleanings, and maintenance — and make sure your place looks lived-in during the off-season.

Expect management fees between 15–30% of rental income. In return, you get peace of mind and usually better rental performance.

Questions to ask before hiring:

- How do you market and price your listings?

- What’s your guest screening process?

- Do you manage off-season maintenance and storm checks?

- How often will I get financial reports and updates?

How to Buy a Vacation Home in Juneau County

Here’s the smart route to success:

- Work with a local expert who knows the Castle Rock Lake market — rural properties have unique quirks like the 100′ waterfront strip, septics, and access rights.

- Research zoning and rental rules. Some townships have limits on short-term stays or require permits.

- Visit in multiple seasons to understand access, road conditions, and local traffic.

- Don’t overestimate rental income — base your numbers on actual comps, not optimistic projections.

The Bottom Line

Owning a vacation home near Castle Rock Lake is more than a dream — it’s an investment in your lifestyle. Whether you want a personal getaway or an income-generating lake property, this part of Juneau County, Wisconsin, has everything you need for four-season enjoyment and long-term growth.

Just make sure you go in with a clear plan, realistic numbers, and a local real estate agent who knows the ins and outs of this market.

When you’re ready to explore vacation homes or investment properties near Castle Rock Lake, I’d love to help you find your perfect fit.